melstclair8777

About melstclair8777

The Complete Guide To Buying Gold: A Timeless Funding

Gold has been a symbol of wealth and a medium of trade for 1000’s of years. Its allure lies not only in its intrinsic beauty but additionally in its capability to retain value over time. In today’s quick-paced financial landscape, many investors are turning to gold as a hedge towards inflation, foreign money fluctuations, and financial uncertainty. This text will discover the key considerations and steps concerned in buying gold, whether or not for investment functions or personal collection.

Understanding Gold as an Investment

Earlier than diving into the strategy of purchasing gold, it is important to grasp why gold is considered a precious asset. Gold has historically maintained its buying power, making it a reliable store of worth. In contrast to paper forex, which will be printed in limitless quantities, gold is a finite useful resource. This scarcity, mixed with its common attraction, makes gold a sought-after commodity in instances of financial instability.

Traders typically buy gold to diversify their portfolios and protect themselves towards market volatility. Gold tends to move inversely to inventory markets; when equities decline, gold prices usually rise. This inverse relationship makes gold a pretty choice for threat-averse traders trying to stabilize their holdings.

Varieties of Gold Investments

When contemplating the purchase of gold, it’s important to know the completely different kinds by which gold might be acquired. If you have any queries relating to the place and how to use Suggested Internet site, you can contact us at our web site. The first types of gold investments include:

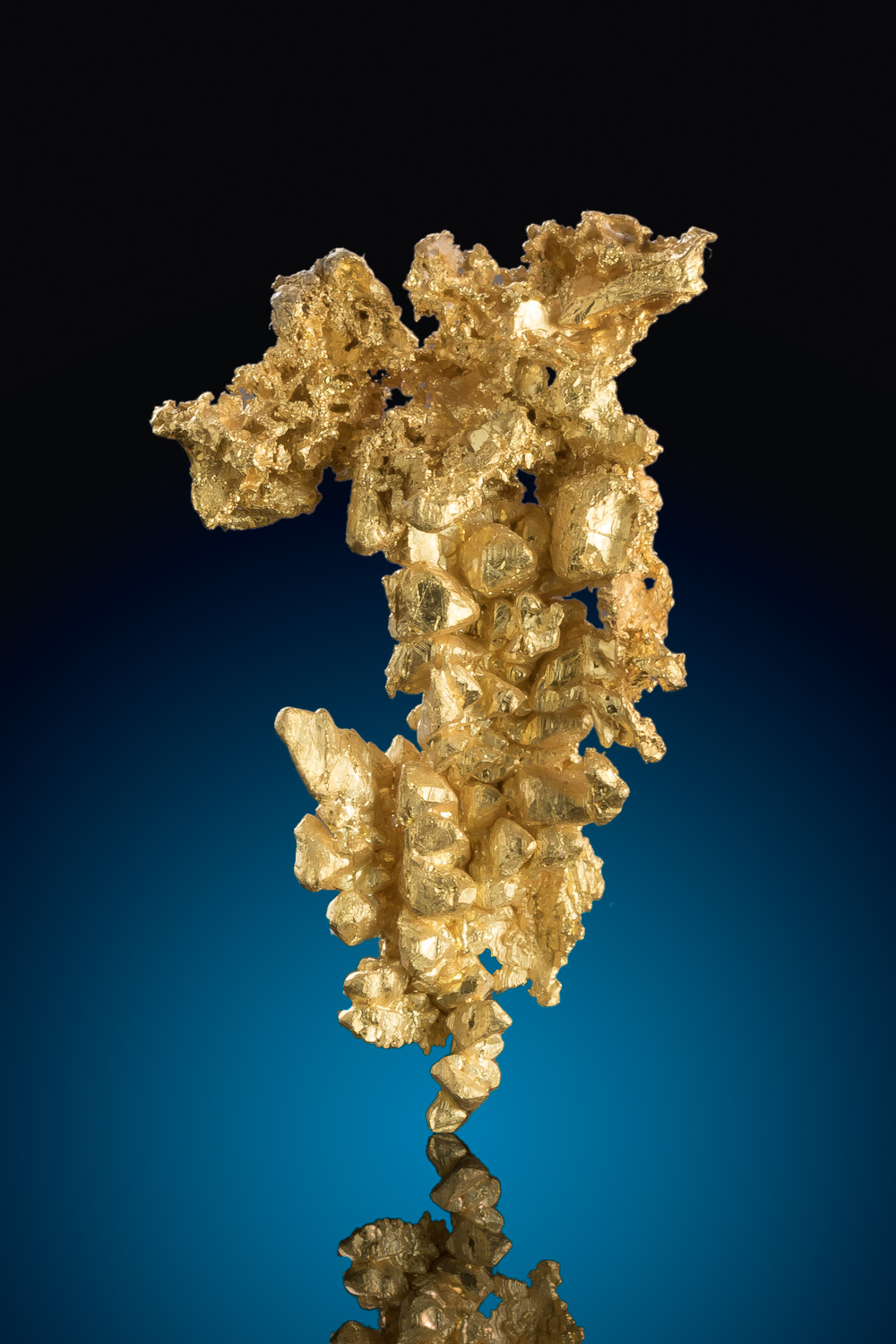

- Bodily Gold: This consists of gold coins, bars, and jewellery. Physical gold offers tangible worth and may be stored at house or in a secure vault. Nonetheless, it requires cautious consideration concerning storage and insurance coverage.

- Gold ETFs (Alternate-Traded Funds): These funds observe the worth of gold and may be traded on stock exchanges. Investing in gold ETFs allows for easy accessibility to gold with out the necessity for bodily storage. However, investors should remember of administration fees and the potential for market volatility.

- Gold Mining Stocks: Investing in shares of gold mining corporations can present exposure to gold prices while additionally providing the potential for dividend income. Nonetheless, mining stocks will be affected by operational risks and administration choices, making them more risky than bodily gold.

- Gold Futures and Options: These financial contracts enable traders to speculate on the long run value of gold. While they will provide vital returns, they also include high threat and are generally more suitable for skilled buyers.

Components to contemplate When Buying Gold

- Market Analysis: Before making a purchase, it is essential to conduct thorough market research. Monitor gold prices, understand market trends, and analyze financial indicators which will affect gold prices. Sources akin to monetary news websites, gold value tracking apps, and market analysis reviews can present helpful insights.

- Purity and Quality: Gold is measured in karats, with 24 karats being pure gold. When buying bodily gold, guarantee that you’re purchasing from reputable dealers who provide certification of purity. This is especially vital for gold coins and bars, as counterfeit merchandise might be prevalent available in the market.

- Supplier Repute: Whether purchasing physical gold or investing in gold ETFs, it is crucial to decide on reputable sellers or financial institutions. Search for sellers with positive evaluations, transparent pricing, and a history of ethical practices. For bodily gold, consider sellers who are members of acknowledged business associations.

- Pricing and Premiums: The price of gold fluctuates primarily based on market circumstances, but further premiums may apply when shopping for physical gold. These premiums cover the prices of minting, distribution, and vendor markups. Compare costs throughout completely different dealers to ensure you’re getting a fair deal.

- Storage and Insurance coverage: Should you decide to spend money on physical gold, consider how you’ll retailer it. Options embrace house safes, safety deposit boxes, or specialized storage services. Moreover, insuring your gold towards theft or loss is a prudent step to guard your investment.

The Shopping for Process

- Decide Your Funding Strategy: Earlier than making any purchases, clarify your funding goals. Are you looking for short-time period positive aspects or long-time period safety? This resolution will influence the kind of gold funding that’s greatest for you.

- Set a Funds: Establish a finances for your gold purchase. Consider how much of your total investment portfolio you need to allocate to gold. A typical advice is to restrict gold investments to 5-10% of your total portfolio, depending in your danger tolerance.

- Select the suitable Form of Gold: Primarily based in your analysis and investment technique, resolve whether or not to buy physical gold, gold ETFs, or mining stocks. Every option has its advantages and disadvantages, so select the one that aligns together with your goals.

- Make the acquisition: Once you have chosen a seller or platform, proceed with the purchase. For physical gold, ensure you receive a receipt and any relevant documentation relating to purity and authenticity. If buying gold ETFs or stocks, follow the standard brokerage procedures to complete your transaction.

- Monitor Your Funding: After buying gold, control market conditions and price fluctuations. Gold might be an extended-time period investment, however staying informed will provide help to make timely choices regarding buying or promoting.

Conclusion

Buying gold can be a rewarding funding technique, providing a hedge against financial uncertainty and a means of wealth preservation. By understanding the different types of gold investments, conducting thorough research, and punctiliously considering your buying options, you can make informed choices that align along with your financial goals. Whether you select to put money into physical gold, ETFs, or mining stocks, the bottom line is to approach gold funding with a effectively-thought-out technique and a transparent understanding of the market dynamics at play. As history has shown, gold remains a timeless asset that may present stability and security in an ever-altering financial panorama.

No listing found.